Safeguarding Trust: Why Data Privacy is Critical for Insurance Companies

Data privacy has become a pressing concern for every industry, but it holds unique significance in the insurance sector. Insurance companies handle vast amounts of sensitive personal and financial information, making them prime targets for cyberattacks and data breaches. Beyond the legal requirements, maintaining robust data privacy practices is essential for building trust with customers and ensuring long-term business sustainability.

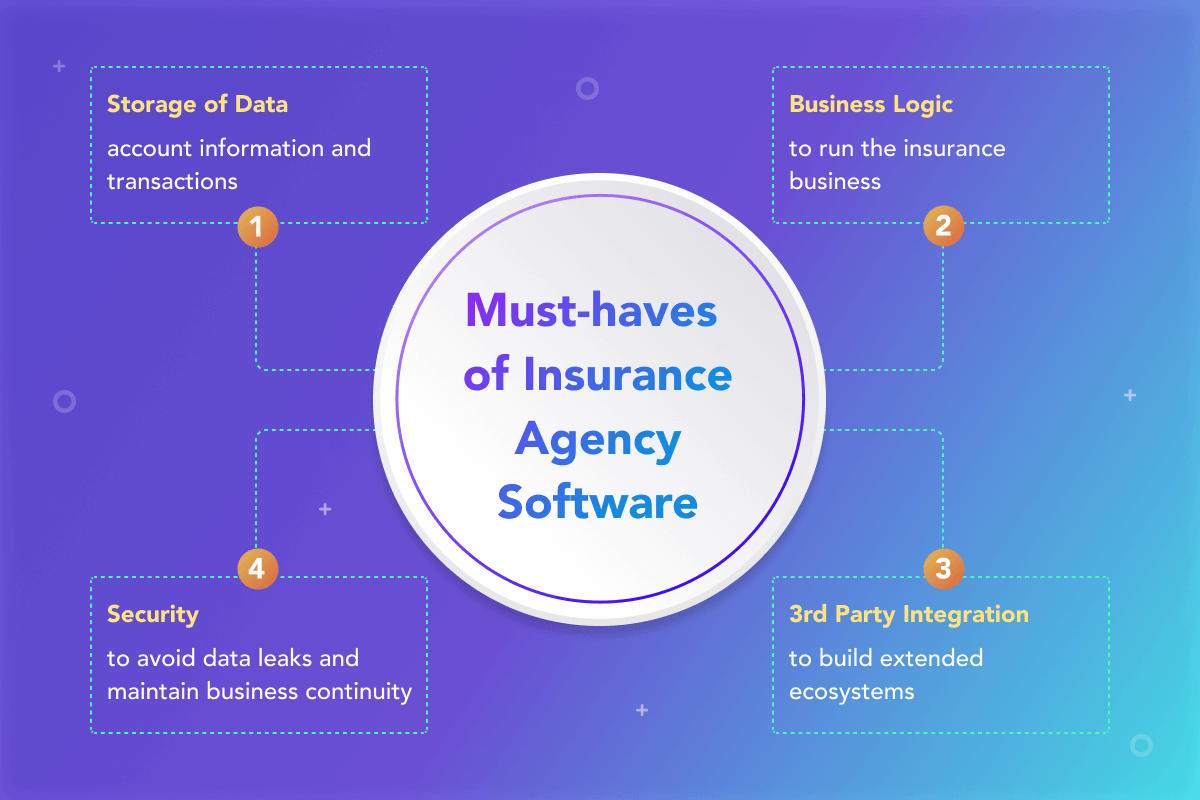

One way insurance companies address these challenges is by implementing advanced insurance systems. These systems not only enhance operational efficiency but also provide secure frameworks for managing customer data. A well-integrated system helps insurers comply with privacy regulations and safeguards sensitive information against unauthorized access.

Contents

Why Data Privacy Matters in Insurance

The nature of the insurance industry requires companies to collect and store highly sensitive data, such as medical histories, financial records, and identification details. Mishandling this information can lead to devastating consequences, including identity theft, financial fraud, and reputational damage for both the company and its customers.

Key Reasons Data Privacy is Essential

- Building Customer Trust

Customers are more likely to engage with insurance providers that prioritize data security. A reputation for robust privacy practices can become a competitive advantage in a crowded market. - Regulatory Compliance

Governments worldwide have implemented stringent data privacy laws, such as GDPR in Europe and CCPA in California. Failure to comply with these regulations can result in hefty fines and legal repercussions. - Preventing Cybersecurity Threats

Insurance companies are prime targets for hackers due to the volume and value of the data they handle. Strong privacy measures reduce the risk of breaches and protect against costly cyberattacks. - Operational Integrity

Data breaches can disrupt business operations, leading to downtime and financial losses. A focus on privacy ensures smoother workflows and uninterrupted services.

How Insurance Systems Enhance Data Privacy

Advanced insurance systems play a pivotal role in safeguarding customer data. These systems are designed with security as a core feature, offering multiple layers of protection against potential threats.

Key Features of Secure Insurance Systems

- Encryption

Encryption ensures that customer data remains unreadable to unauthorized parties, even if intercepted during transmission. - Access Controls

Role-based access restricts data visibility to authorized personnel only, minimizing the risk of internal breaches. - Audit Trails

Comprehensive logs track who accessed data and when, enabling companies to identify and respond to suspicious activities. - Regular Updates

Insurance systems that are frequently updated with the latest security patches are better equipped to handle emerging threats. - Data Minimization

Advanced systems help insurers collect only the data they need, reducing exposure to unnecessary risks.

Challenges in Maintaining Data Privacy

Despite technological advancements, ensuring data privacy in the insurance sector remains a challenging task.

- Evolving Cyber Threats

Hackers constantly develop new techniques to exploit vulnerabilities, requiring companies to stay ahead with proactive measures. - Complex Regulations

Navigating varying privacy laws across regions can be difficult for insurers operating in multiple jurisdictions. - Third-Party Risks

Insurance companies often rely on third-party vendors for claims processing or data analytics. Ensuring these vendors adhere to the same privacy standards is critical. - Balancing Privacy with Innovation

Insurers are increasingly adopting AI and big data analytics to offer personalized services. However, these technologies must be implemented without compromising customer privacy.

Best Practices for Data Privacy in Insurance

To address these challenges, insurance companies should adopt best practices that prioritize data security and customer trust.

- Invest in Secure Systems

Advanced insurance systems provide the tools needed to manage and secure sensitive information effectively. - Employee Training

Employees should be educated on privacy policies and trained to recognize phishing attempts or other cyber threats. - Regular Security Audits

Conducting periodic audits helps identify vulnerabilities and ensures compliance with regulatory standards. - Transparent Privacy Policies

Customers should understand how their data is collected, stored, and used. Transparency builds trust and demonstrates a commitment to privacy. - Incident Response Plans

A well-defined response plan minimizes damage in the event of a breach, ensuring quick action and clear communication with affected parties.

The Future of Data Privacy in Insurance

As technology evolves, so do the expectations around data privacy. Emerging trends like blockchain technology and zero-trust architectures offer promising solutions for enhancing security in the insurance sector. Additionally, regulatory frameworks will continue to tighten, pushing companies to adopt even more rigorous standards.

Insurance providers that stay ahead of these trends will not only protect their customers but also strengthen their market position.

Conclusion

Data privacy is more than a regulatory requirement for insurance companies—it’s a fundamental aspect of building trust and ensuring operational resilience. With sensitive customer information at stake, adopting secure insurance systems is critical for protecting against threats and maintaining compliance. By prioritizing privacy, insurers can safeguard their reputation, foster customer loyalty, and navigate the complexities of the digital age with confidence.