Bank Statement Analysis Software: Unveiling Financial Insights with Payslip Data Digitization

Bank statement analysis software has emerged as a powerful tool for individuals and businesses seeking to gain valuable insights into their financial health. In today’s data-driven world, these software solutions leverage advanced technologies to analyze bank transactions, detect patterns, and provide actionable recommendations. This article explores the functionalities, benefits, and significance of bank statement analysis software, with a focus on the integration of payslip data digitization for enhanced financial understanding.

Understanding Bank Statement Analysis Software

Bank statement analysis software is a sophisticated digital solution designed to streamline the process of examining and interpreting financial transactions. These tools go beyond basic transaction categorization, offering comprehensive insights into spending habits, income sources, budgeting, and more. By harnessing the power of data analytics and automation, these software platforms empower users to make informed financial decisions.

Key Features of Bank Statement Analysis Software

1. Transaction Categorization and Classification:

– Automates the categorization of transactions into various expense categories such as groceries, utilities, entertainment, etc.

– Utilizes machine learning algorithms to intelligently classify transactions, reducing manual effort and improving accuracy.

2. Anomaly Detection and Fraud Prevention:

– Sophisticated algorithms identify irregularities, suspicious activities, or potential fraud within the bank statements.

– Real-time alerts notify users of unusual spending patterns, unauthorized transactions, or discrepancies in account balances.

3. Trend Analysis and Forecasting:

– Analyzes historical transaction data to uncover trends, patterns, and seasonality in spending behaviors.

– Provides forecasting tools that use predictive analytics to estimate future expenses, income trends, and account balances.

4. Expense Management and Budget Tracking:

– Offers tools for tracking expenses, setting budgets, and monitoring spending against predefined limits.

– Helps users identify areas for cost-cutting, optimize spending, and achieve financial goals.

5. Visualizations and Reports:

– Presents financial data in intuitive graphs, charts, and visualizations for easy interpretation.

– Generates customizable reports that provide summaries, trends, comparisons, and insights for informed decision-making.

6. Integration with Accounting Systems:

– Seamlessly integrates with accounting software to synchronize bank statement data with financial records.

– Streamlines reconciliations, updates ledgers, and generates accurate financial reports without manual data entry.

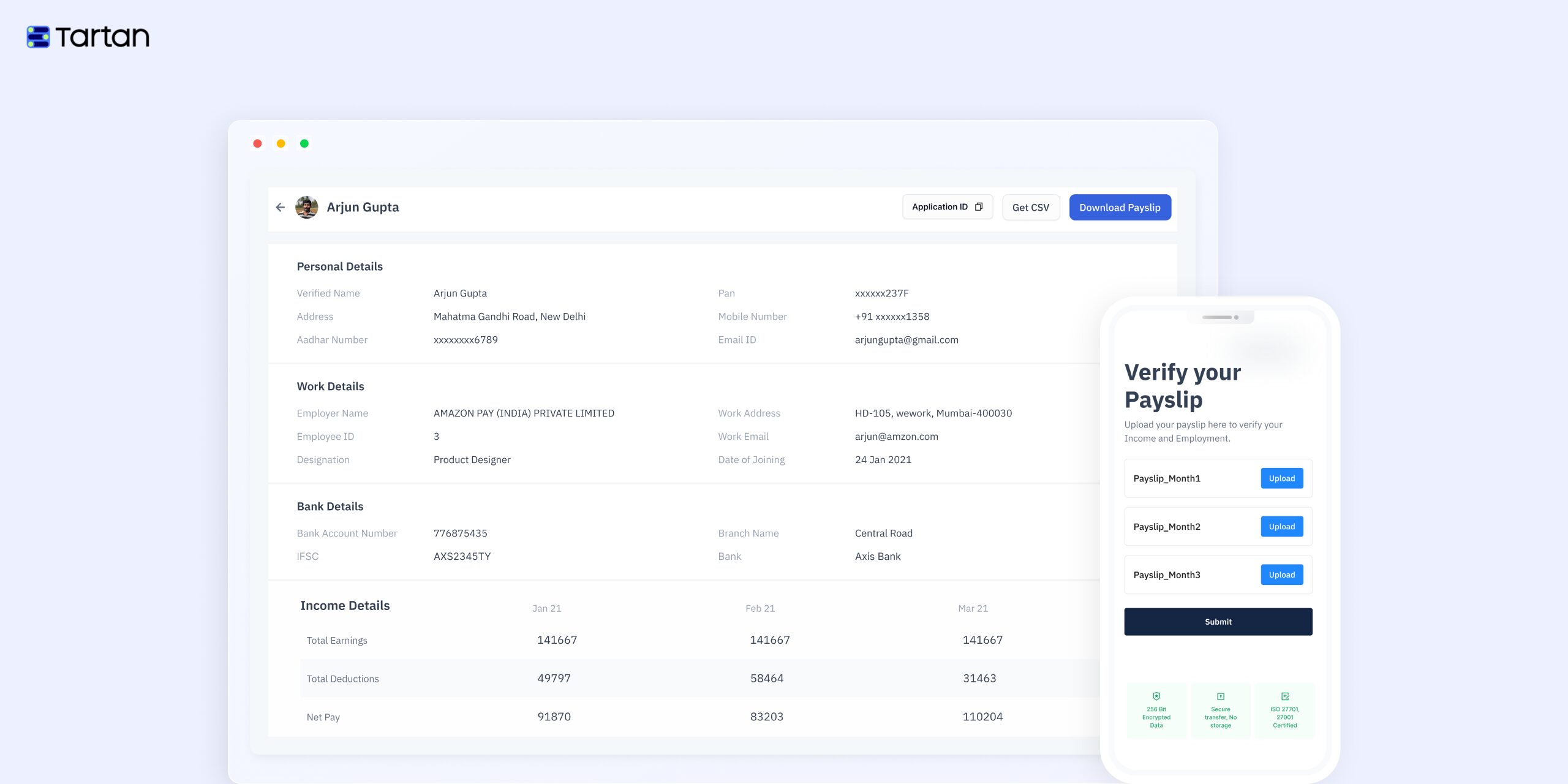

7. Payslip Data Digitization and Analysis:

– Integrates payslip data digitization to provide a comprehensive view of income sources, deductions, and net earnings.

– Analyzes payslip data to understand labor costs, employee compensation trends, and payroll management.

8. Customer Segmentation and Personalization:

– Segments customers based on their spending behaviors, preferences, and financial goals.

– Offers personalized financial recommendations, product suggestions, and investment opportunities tailored to individual profiles.

9. Compliance and Regulatory Support:

– Ensures compliance with financial regulations, anti-money laundering (AML) laws, and data protection requirements.

– Provides audit trails, encryption protocols, and secure data storage to protect sensitive financial information.

10. Mobile Accessibility and Alerts:

– Offers mobile applications for convenient access to bank statement analysis tools on-the-go.

– Sends real-time notifications, transaction alerts, and updates on account activities directly to users’ mobile devices.

Benefits of Bank Statement Analysis Software

1. Enhanced Financial Visibility:

– Provides users with a clear, real-time view of their financial health, including account balances, cash flows, and net worth.

– Insights into spending habits, income sources, and saving trends empower users to make informed financial decisions.

2. Improved Expense Management:

– Automates expense tracking, categorization, and budget monitoring for efficient financial management.

– Helps users identify unnecessary expenses, track spending trends, and allocate funds wisely.

3. Efficient Fraud Detection and Risk Mitigation:

– Detects irregularities, unusual activities, or potential fraud within bank transactions.

– Early detection and alerts mitigate financial risks, safeguard against identity theft, and protect against unauthorized transactions.

4. Strategic Planning and Forecasting:

– Utilizes trend analysis and forecasting tools to provide insights into future financial scenarios.

– Assists in investment decisions, retirement planning, and major purchases through data-driven forecasts and projections.

5. Streamlined Accounting Processes:

– Integrates seamlessly with accounting systems to automate reconciliations, update ledgers, and generate accurate financial reports.

– Reduces manual data entry errors, improves efficiency, and ensures financial statements are up-to-date.

6. Personalized Financial Recommendations:

– Offers customized product offers, investment advice, and savings goals based on individual financial profiles.

– Tailored recommendations enhance user engagement, satisfaction, and financial success.

7. Time and Cost Savings:

– Automates transaction categorization, budget tracking, and report generation, saving users time and effort.

– Minimizes potential financial losses, accounting discrepancies, and operational inefficiencies.

Integrating Payslip Data Digitization for Comprehensive Analysis

The integration of payslip data digitization adds a layer of depth and granularity to bank statement analysis software. By incorporating payslip data, users gain a comprehensive view of their financial landscape, including detailed insights into income, deductions, taxes, and employee compensation. Here’s how payslip data digitization enhances the capabilities of bank statement analysis software:

1. Labor Costs and Employee Compensation:

– Analyzes payslip data to understand labor costs, employee salaries, bonuses, benefits, and payroll taxes.

– Provides insights into employee compensation trends, performance-based incentives, and payroll management.

2. Budgeting and Resource Allocation:

– Incorporates payslip data to accurately forecast labor costs, plan for salary increases, and budget for employee benefits.

– Helps businesses optimize resource allocation, control expenses, and achieve financial targets.

3. Compliance and Regulatory Requirements:

– Ensures compliance with labor laws, tax regulations, and payroll reporting requirements through payslip data analysis.

– Generates accurate reports for tax filings, audits, and regulatory submissions.

4. Employee Performance and Productivity:

– Correlates payslip data with performance metrics to assess employee productivity, efficiency, and contribution to business goals.

– Identifies top performers, recognizes achievements, and incentivizes employee engagement through data-driven insights.

5. Cost Analysis and Profitability:

– Integrates payslip data with financial statements to analyze labor costs as a component of overall expenses.

– Provides insights into the impact of employee compensation on profitability, margins, and business growth.

6. Forecasting and Financial Planning:

– Utilizes payslip data for accurate forecasting of labor expenses, hiring needs, and workforce planning.

– Assists in strategic financial planning, budget forecasting, and scenario analysis based on comprehensive payslip insights.

Conclusion

Bank statement analysis tool and software, enriched with payslip data digitization, empowers individuals and businesses with comprehensive financial insights. These advanced tools automate transaction categorization, detect anomalies, and provide personalized recommendations for efficient financial management. By harnessing the power of data analytics in fintech, users gain real-time visibility into their financial health, improve expense management, and mitigate risks effectively.